Contents

- 1 Introduction

- 2 Understanding Solar Panels and Their Benefits

- 3 Introduction to Solar Panel Tax Credits

- 4 How the Federal Solar Investment Tax Credit Works

- 5 The Timeline of the ITC

- 6 State and Local Solar Incentives

- 7 Financial Benefits of Solar Panel Tax Credits

- 8 Case Studies: Real-Life Examples

- 9 Important Considerations and Best Practices

- 10 Conclusion

Introduction

Solar panel tax credit in recent years, solar energy has emerged as a clean, sustainable, and economically viable source of power. As the world grapples with the consequences of climate change and increasing demand for renewable energy sources, solar power has become an attractive option for homeowners and businesses alike. One of the significant incentives encouraging the adoption of solar panels in the United States is the solar panel tax credit. This tax credit not only benefits the environment but also has the potential to significantly impact your finances. In this article, we will delve into the world of solar panel tax credits, exploring what they are, how they work, and the financial benefits they offer.

Understanding Solar Panels and Their Benefits

Before delving into the intricacies of solar panel tax credits, it’s crucial to understand the basics of solar panels and why they are considered a game-changer for the energy industry.

Solar panels, also known as photovoltaic (PV) panels, are devices that convert sunlight into electricity. They consist of multiple solar cells that harness the sun’s energy and convert it into usable electrical power. Solar panels offer several benefits, including:

a. Environmental Benefits:

- Reduced Greenhouse Gas Emissions: Solar panels produce electricity without emitting harmful greenhouse gases, making them a clean and eco-friendly energy source.

- Decreased Reliance on Fossil Fuels: Solar energy reduces our dependence on fossil fuels, which are finite resources with negative environmental impacts.

b. Economic Benefits:

- Lower Electricity Bills: Solar panels generate free electricity, reducing your monthly energy costs.

- Increased Property Value: Homes with solar panels are often valued higher in the real estate market.

- Job Creation: The solar industry has seen significant growth, creating jobs and stimulating economic development.

c. Energy Independence:

- Solar panels allow homeowners and businesses to generate their own electricity, reducing reliance on external power sources and the grid.

Introduction to Solar Panel Tax Credits

Solar panel tax credits, often referred to as solar incentives, are financial incentives provided by governments to promote the adoption of solar energy systems. In the United States, the most well-known solar tax credit is the Federal Investment Tax Credit (ITC), also known as the Solar Investment Tax Credit.

The Solar Investment Tax Credit (ITC) was introduced as part of the Energy Policy Act of 2005 and has been extended and modified over the years. This federal incentive allows individuals and businesses to deduct a percentage of the cost of installing solar panels from their federal income taxes. The ITC (Solar investment tax credit) has played a pivotal role in driving the growth of the solar industry in the United States.

How the Federal Solar Investment Tax Credit Works

The Federal Solar Investment Tax Credit (Solar panel tax credit) operates by providing a tax credit to individuals or businesses that invest in solar energy systems. Here’s how it works:

a. Eligibility: To be eligible for the ITC (Solar investment tax credit), you must be the owner of a residential or commercial solar energy system. Leased solar systems typically do not qualify for the credit.

b. Credit Percentage: The ITC (Solar investment tax credit) offers a solar panel tax credit equal to a percentage of your qualified solar investment costs. As of my last knowledge update in 2022, the ITC (Solar investment tax credit) offers a credit equal to 26% of the eligible costs for solar panel installation. This percentage may change in subsequent years, so it’s essential to check the current rate.

c. Qualified Solar Property: The ITC (Solar investment tax credit) covers the installation of solar panels, as well as associated components such as inverters, wiring, and mounting equipment. Solar water heaters and solar thermal systems may also qualify for the credit.

d. Claiming the Credit: To claim the credit, you must complete IRS Form 5695 when filing your federal income tax return. The credit is applied directly to your tax liability, reducing the amount of taxes you owe or increasing your tax refund.

e. Carryover Provision: If the tax credit exceeds your tax liability for the year in which you install the solar panels, you can carry over the remaining credit to the following tax year.

The Timeline of the ITC

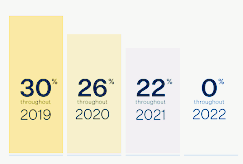

It’s essential to be aware of the timeline associated with the ITC to maximize its benefits. The ITC has undergone several adjustments over the years:

a. Original ITC (2005-2007): The ITC (Solar investment tax credit) was first introduced in the Energy Policy Act of 2005, offering a 30% tax credit for residential and commercial solar installations.

b. Temporary Extensions: The ITC (Solar investment tax credit) has been extended multiple times, with different credit percentages. For instance, it was extended through the end of 2019 with a 30% credit for residential and commercial systems.

c. Current ITC (2022-2023): As of my last update in 2022, the ITC offers a 26% tax credit for solar installations that commence construction in 2022. This percentage is expected to decrease to 22% for systems that begin construction in 2023.

d. Future Changes: Beyond 2023, the ITC (Solar investment tax credit) for residential solar installations is expected to drop to 10%, while it will be eliminated for commercial installations.

It’s important to stay updated on the latest ITC (Solar investment tax credit) developments to ensure you take full advantage of this financial incentive.

State and Local Solar Incentives

In addition to the Federal ITC (Solar investment tax credit), many states, and local governments offer their own solar incentives to promote renewable energy adoption. These incentives can further reduce the cost of going solar and enhance your financial benefits. Some common state and local incentives include:

a. Solar Rebates: These are cash incentives provided by utilities or state programs to reduce the upfront cost of solar panel installation.

b. Solar Renewable Energy Credits (SRECs): SRECs are tradable certificates earned for generating a certain amount of solar electricity. They can be sold in a market, providing an additional income stream.

c. Property Tax Exemptions: Some states offer property tax exemptions for solar energy systems, reducing the property tax associated with the increased home value.

d. Sales Tax Exemptions: Solar equipment purchases are sometimes exempt from sales tax, reducing the overall cost of installation.

e. Net Metering: Net metering programs allow homeowners to earn credits for excess electricity produced by their solar panels and feed it back into the grid.

The availability and extent of these incentives vary by location, so it’s essential to research what is offered in your area.

Financial Benefits of Solar Panel Tax Credits

Now that we’ve covered the fundamentals of solar panel tax credits and incentives let’s dive into the financial benefits they offer:

a. Cost Reduction: The most obvious financial benefit is the reduction in the cost of installing solar panels. The ITC (Solar investment tax credit), combined with state and local incentives, can significantly offset the upfront expenses, making solar energy more accessible to a broader range of individuals and businesses.

b. Lower Payback Period: With incentives in place, the time it takes to recoup your initial investment in solar panels is reduced. This means that you’ll start enjoying the savings from your reduced energy bills sooner.

c. Increased Home Value: Homes with solar panels tend to have higher property values. So, not only do you save money on energy costs, but you also potentially increase the resale value of your home.

d. Energy Savings: Solar panels generate free electricity, reducing your reliance on the grid and lowering your monthly energy bills. Over time, these savings can be substantial.

e. Environmental Benefits: While not a direct financial benefit, the positive environmental impact of solar energy must not be underestimated. As the world grapples with the consequences of climate change, the reduction in greenhouse gas emissions and a decreased reliance on fossil fuels, both facilitated by solar energy, can lead to a healthier planet. This, in turn, can have long-term economic benefits for society as a whole, such as reduced healthcare costs and mitigation of climate-related damages.

f. Tax Benefits: Solar panel tax credits directly impact your tax liability, reducing the amount you owe to the government or increasing your refund. This effectively puts more money back into your pocket.

g. Protection Against Rising Energy Costs: Over the past few decades, energy costs have consistently risen. By investing in solar panels, you shield yourself from the impact of these cost increases. This is particularly significant for businesses with high energy consumption.

h. Solar Incentive Stacking: One of the most powerful financial strategies is to stack solar incentives. By combining the Federal ITC with state and local incentives, you can significantly reduce the cost of your solar installation. This can result in substantial savings and a shorter payback period.

i. Income Generation: If your solar panels produce excess electricity, some programs allow you to sell this surplus energy back to the grid, generating additional income through net metering or through the sale of Solar Renewable Energy Credits (SRECs).

j. Energy Independence: Solar panels enable homeowners and businesses to generate their own electricity, reducing their reliance on external energy sources and the grid. This can provide security in the face of power outages or disruptions.

Case Studies: Real-Life Examples

To better illustrate the financial benefits of solar panel tax credits, let’s explore a couple of hypothetical case studies:

a. Residential Installation: Imagine a family in California that decides to install a residential solar panel system with an initial cost of $20,000. They qualify for the Federal ITC, which offers a 26% tax credit. This means they receive a tax credit of $5,200, reducing their installation cost to $14,800. Over the years, they save approximately $1,200 annually on their energy bills. At this rate, they will recoup their initial investment in roughly 12 years. In addition, they’ll see an increase in their property value and benefit from the environmental advantages of solar energy.

b. Commercial Installation: A small business in New York invests in a solar panel system with a total cost of $100,000. The Federal ITC at 26% reduces their installation cost to $74,000. They also receive a state rebate of $10,000 and earn $5,000 annually by selling SRECs. Their annual energy savings amount to $12,000. As a result, the payback period for this commercial installation is approximately 4 years. Over the system’s lifetime, the business is expected to save hundreds of thousands of dollars in energy costs while reducing its environmental footprint.

Important Considerations and Best Practices

While the financial benefits of solar panel tax credits are substantial, it’s important to keep a few considerations in mind:

a. Eligibility Criteria: Ensure that you meet all the eligibility criteria for the tax credits and incentives you intend to apply for. Ownership of the solar energy system, compliance with installation standards, and sometimes even location can impact your eligibility.

b. Tax Liability: Tax credits can only reduce your tax liability. If your tax liability is lower than the credit amount, you may not be able to claim the full credit in a single year. However, many tax credits, including the Federal ITC, offer a carryover provision, allowing you to carry forward unused credits to future years.

c. Consult a Tax Professional: Tax laws and incentives can be complex and change over time. It’s advisable to consult a tax professional or accountant who specializes in renewable energy incentives to ensure you maximize your financial benefits.

d. Ongoing Maintenance: Solar panels require maintenance to operate efficiently over their lifetime. Be prepared for ongoing maintenance costs, and consider this when calculating your financial benefits.

e. Solar Panel Quality: The quality of your solar panel installation matters. High-quality panels can generate more electricity and last longer, increasing your long-term financial benefits.

f. Monitor Energy Usage: To make the most of your solar panels, monitor your energy usage and strive to maximize your self-consumption. This will further enhance your energy savings and financial benefits.

Conclusion

Solar panel tax credits and incentives have transformed the economics of solar energy. By offering financial incentives and reducing the upfront costs of installation, governments at the federal, state, and local levels are encouraging individuals and businesses to adopt solar power. The financial benefits of these incentives are significant and multi-faceted, ranging from reduced installation costs to lower energy bills and increased property values.

However, it’s essential to stay informed about the current status of these incentives, as they may change from year to year. To make the most of solar panel tax credits, consult with experts, carefully consider your energy usage, and invest in high-quality solar panels.

As the world continues its transition to a cleaner, more sustainable energy future, solar energy, and its financial benefits are set to play a vital role in reducing greenhouse gas emissions and securing a brighter, more sustainable future for all.